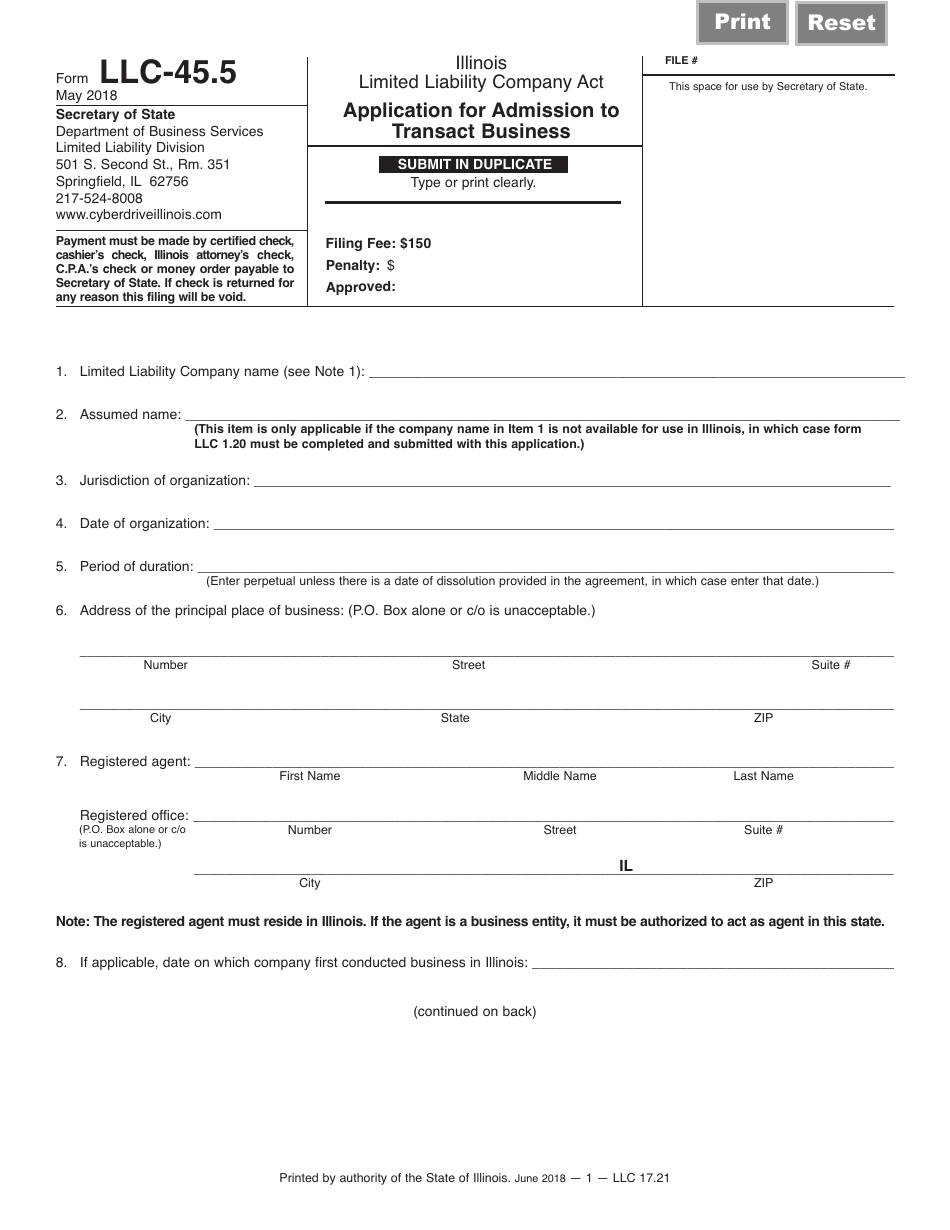

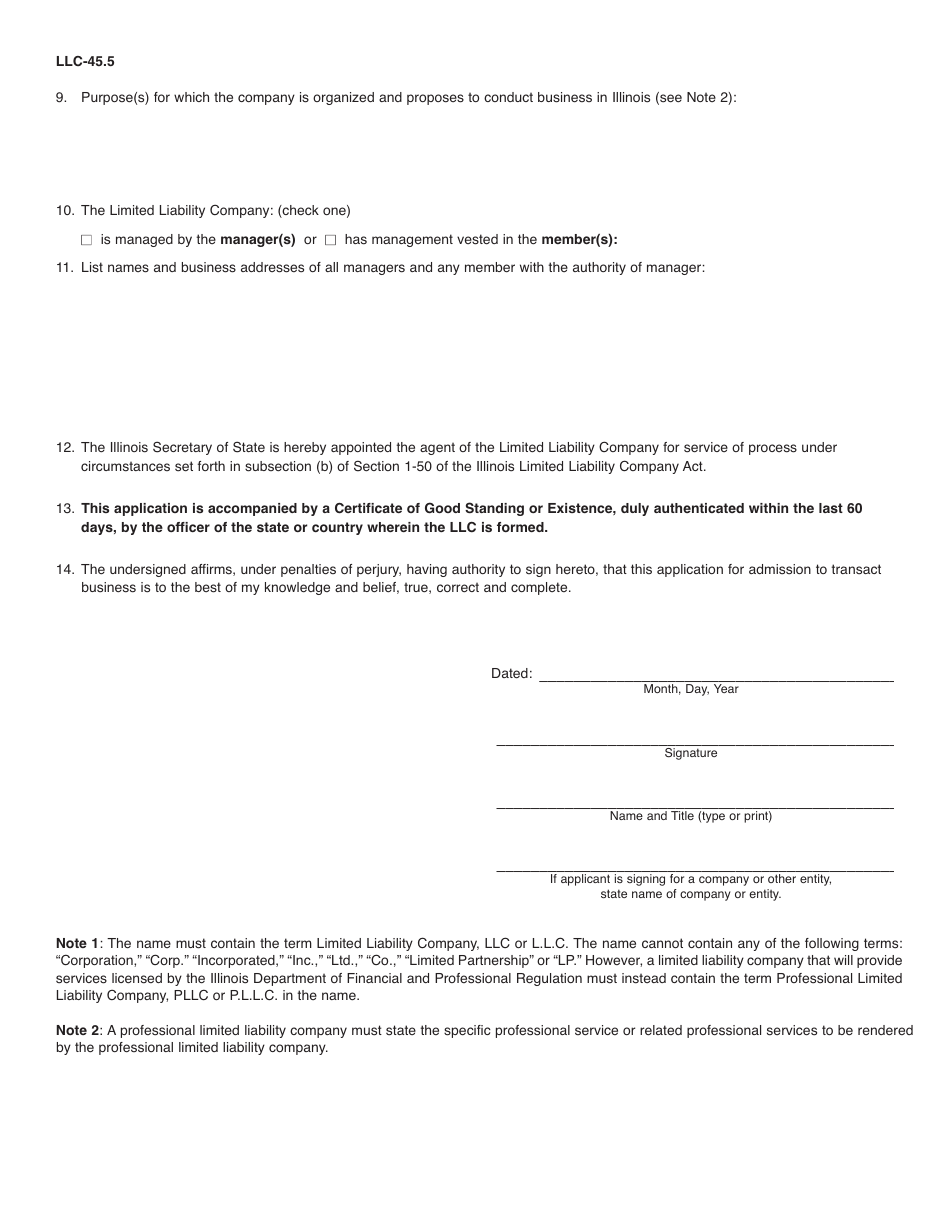

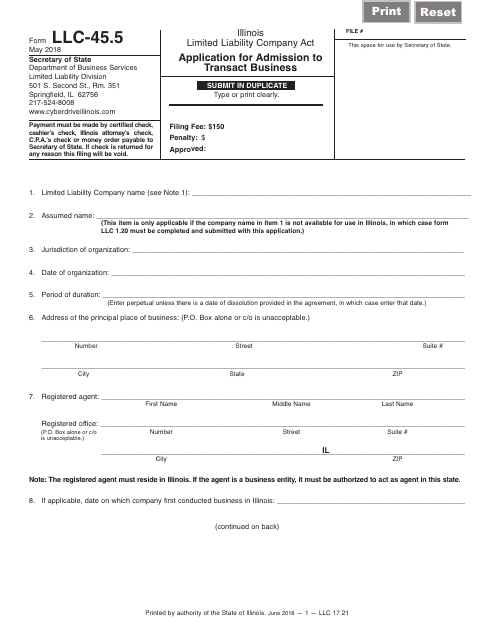

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

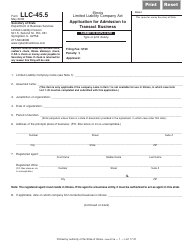

Q: What is the LLC-45.5 Application for Admission to Transact Business?

A: The LLC-45.5 Application for Admission to Transact Business is a form used to apply for permission to conduct business in the state of Illinois as a limited liability company (LLC).

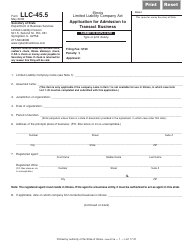

Q: What information is required on the LLC-45.5 Application for Admission to Transact Business?

A: The LLC-45.5 Application for Admission to Transact Business requires information such as the name and address of the LLC, the names and addresses of the LLC's members or managers, and a statement of the LLC's purpose.

Q: Is there a fee for filing the LLC-45.5 Application for Admission to Transact Business?

A: Yes, there is a fee for filing the LLC-45.5 Application for Admission to Transact Business in Illinois. The fee amount can vary, so it is best to check with the Illinois Secretary of State for the current fee schedule.

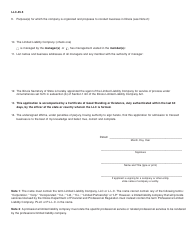

Q: Are there any additional requirements for foreign LLCs filing the LLC-45.5 Application for Admission to Transact Business?

A: Foreign LLCs (LLCs formed in another state or country) will typically need to provide a Certificate of Good Standing or a similar document from their home jurisdiction when filing the LLC-45.5 Application for Admission to Transact Business in Illinois.

Form Details:

Download a fillable version of Form LLC-45.5 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.

1

2

Business Transaction Illinois Secretary of State Limited Liability Company Illinois Legal Forms United States Legal Forms

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.