A retainer agreement is a service agreement supported by financial compensation between a client and an individual providing professional services. Whereas other contractor agreements usually expire after the tasks are completed, a retainer maintains the relationship between client and service provider even if the provider is not constantly performing duties.

The document will describe what services will be performed, the length of the agreement, the type of compensation and method of payment, potential contingency fees, and other key terms and conditions. Entering into this agreement doesn’t mean the provider is an employee, they are considered an independent contractor, the details of which are stated in the written contract.

The professional providing their services should include the tasks, duties, and other actions they will be required to perform for the client. This section will vary greatly depending on the industry, the service provider, the client, and the reason for hiring the professional.

While a retainer is still an extended agreement, the contract should still include a timeframe to establish the start and end of the relationship. The contract can end on a specific date, on the date services are completed, or indefinitely until either of them provides notice to terminate.

The retainer fee should be included in the agreement, and the service provider should indicate whether or not this fee is refundable. In addition to the retainer fee, the service provider will demand their typical compensation rate, which might be an hourly wage, a per-job basis, commission, or another type of payment plan.

Throughout the relationship, the service provider may be required to spend money on expenses directly related to their work for the client. It should be established in the agreement which party will be responsible for these expenses to avoid any confusion or distrust.

The service provider isn’t an employee, so they will not receive certain benefits that the client’s regular staff would receive. The service provider is also responsible for their own licenses, taxes, unemployment and workers’ compensation, insurance, and any other obligations related to providing their services.

In some cases, the service provider may be required to access their client’s confidential information. A non-disclosure clause is often included in retainer agreements to prevent the misuse and dissemination of the client’s proprietary information.

A retainer agreement is a type of contractor agreement wherein a client pays a service provider for a specific job, a set of tasks, or ongoing professional advice or services. These agreements are also known as “work-for-hire” agreements and can be categorized somewhere between a single-use independent contractor agreement and an employment contract. An individual or company kept on retainer can provide services for others, but they are bound by their contract to perform a certain number of duties or work a specific number of hours for their client.

There are two (2) types of retainers: pay for access and pay for work. The type of retainer agreement used is dependent on the industry in which the professional works as well as the relationship between the parties.

A pay for access agreement is signed by experienced professionals to preserve their services over long periods of time. Payment will be made to the service provider regardless of whether or not their services are used in any given pay period. When their services are required, the fee has already been paid, and any additional hours worked will be billed using their normal rate. Typically, a client and service provider will already know and trust one another before entering into a pay for access agreement.

A pay for work agreement is not very different from any other independent contractor agreement in that the service provider will receive steady payments from their client in exchange for hours worked or a task performed. Where this type of retainer agreement differs from a contractor agreement is the perpetuity of the relationship and services provided. Once a payment period ends or the service provider completes a job, their services are retained by the client so that they can delegate more tasks to them.

A retainer fee is the amount of money the client must pay the service provider upfront. It establishes the working arrangement between the parties before services commence and may or may not be refundable, depending on the situation. The fee goes towards the hours of work completed, but additional compensation will be owed if more tasks are performed. The amount of the fee also greatly depends on the type of professional services being rendered, the specific tasks to be performed, and other important factors.

A suitable time to introduce a retainer agreement is when a client finds themselves using a service provider on a regular basis or after an assignment is successfully completed. If the client believes they received good value for their money, they will be more inclined to trust the service provider and invest in a prolonged relationship.

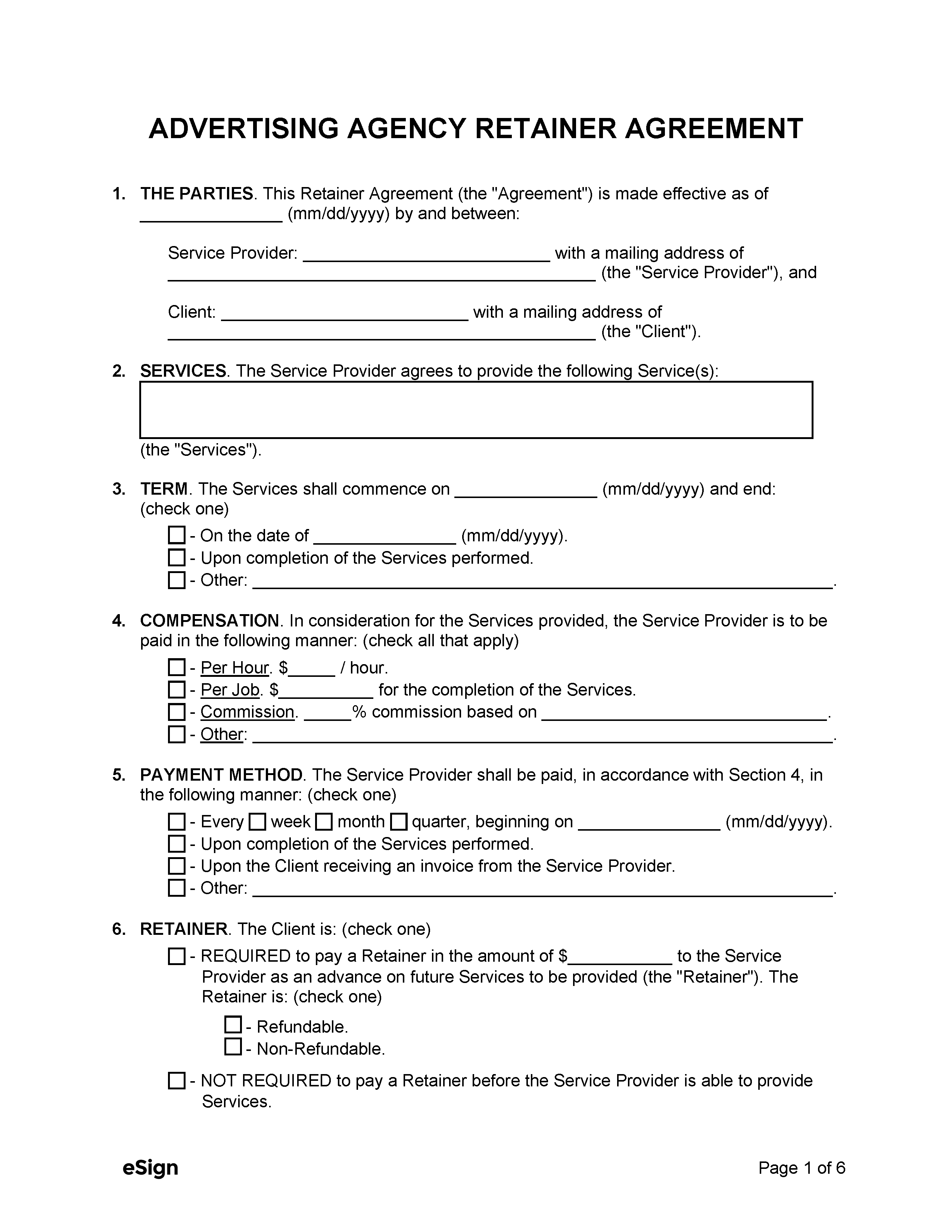

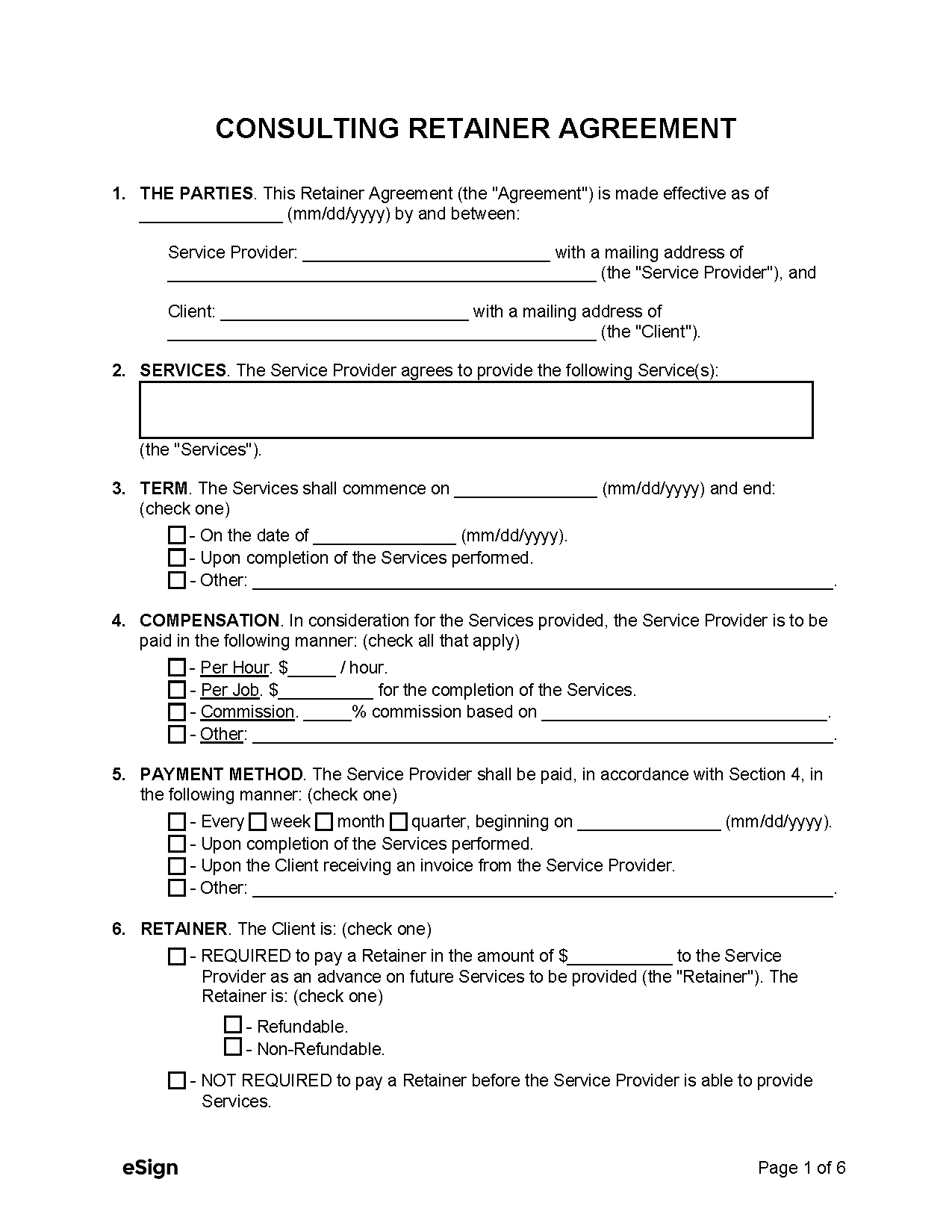

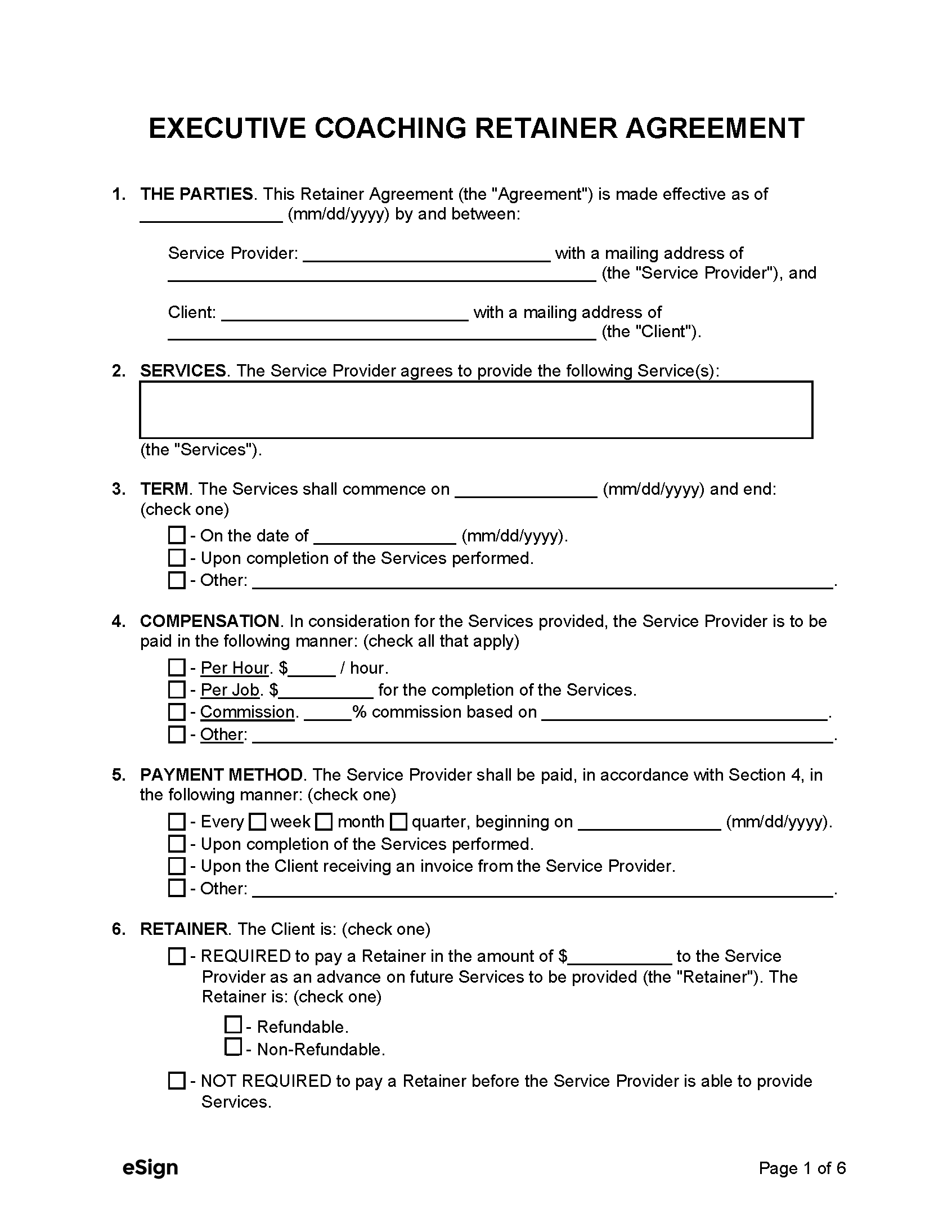

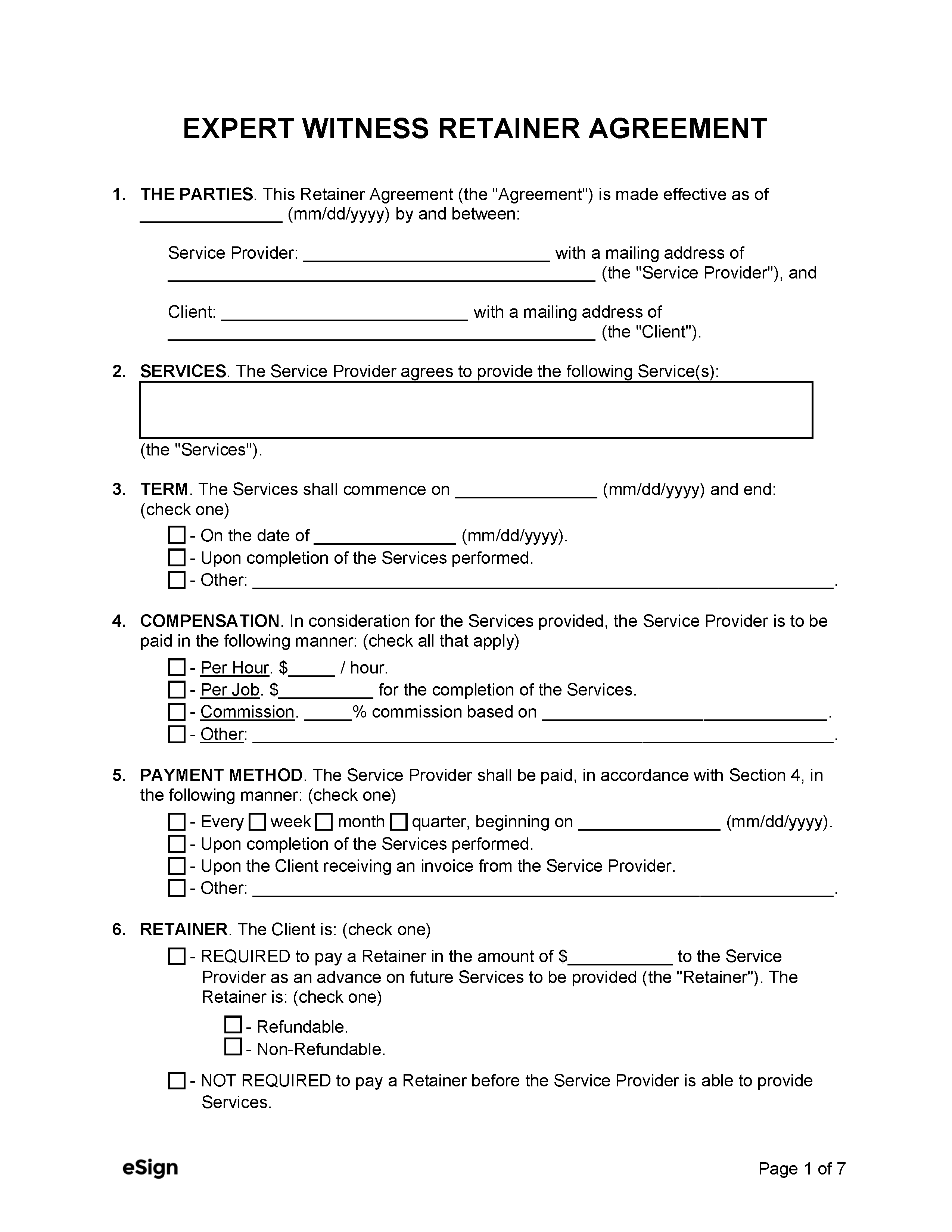

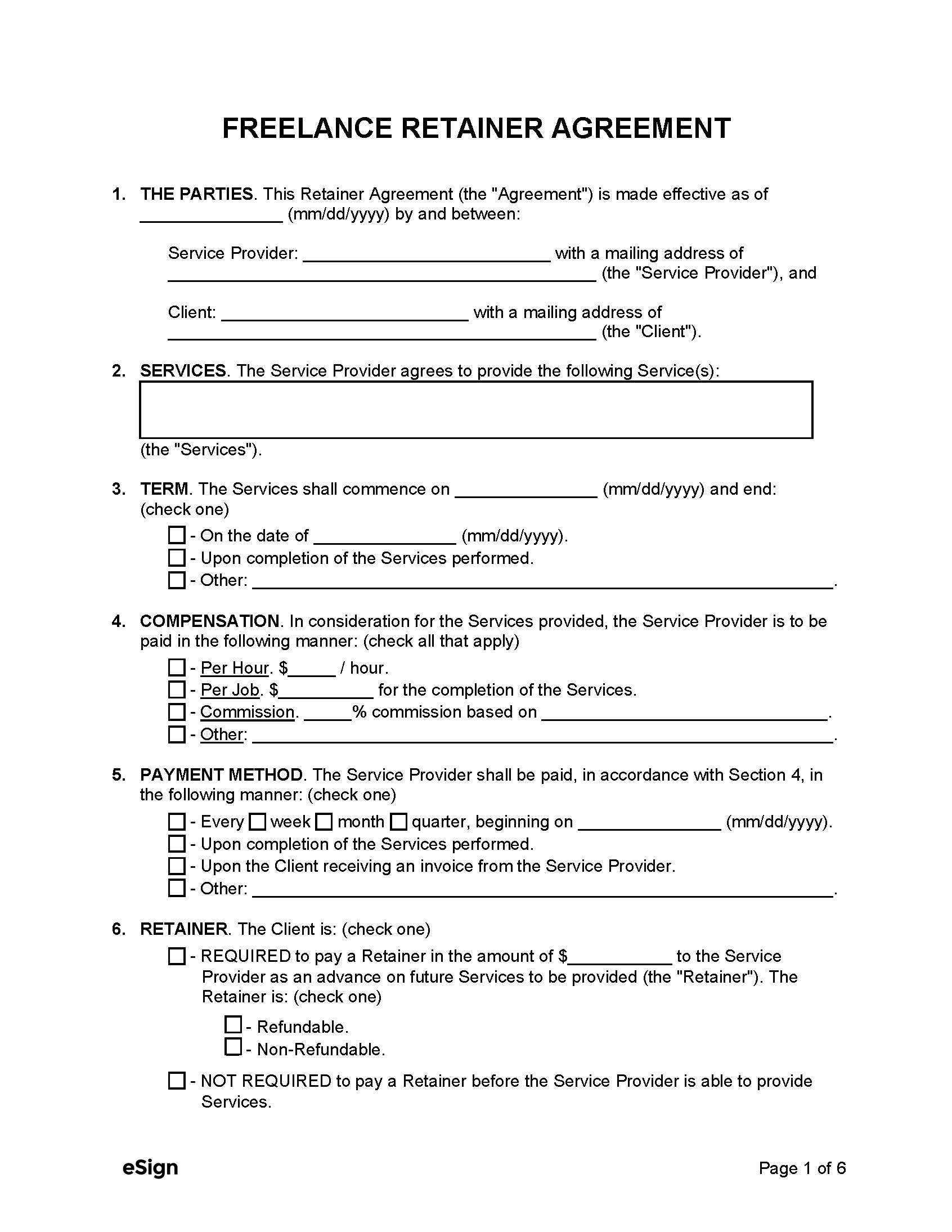

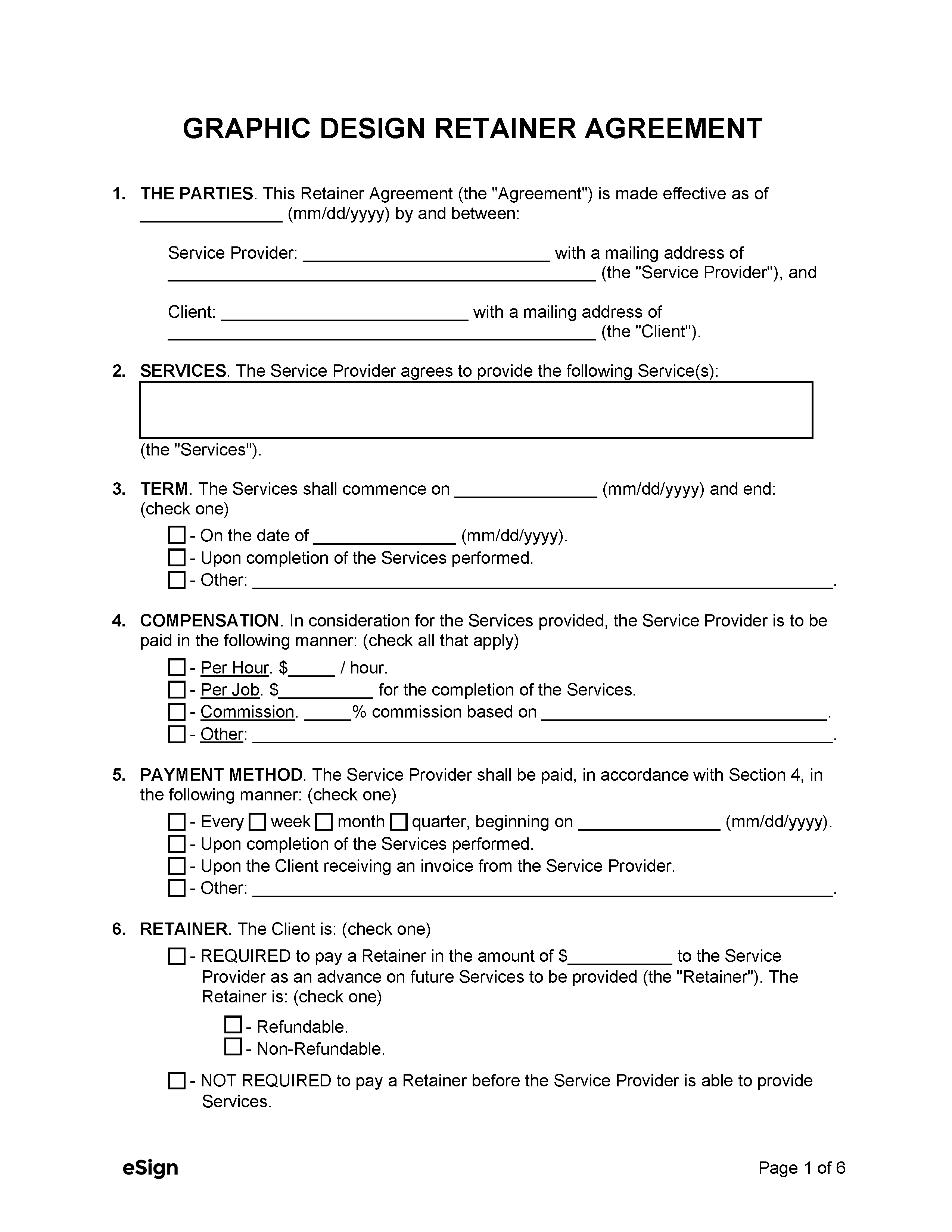

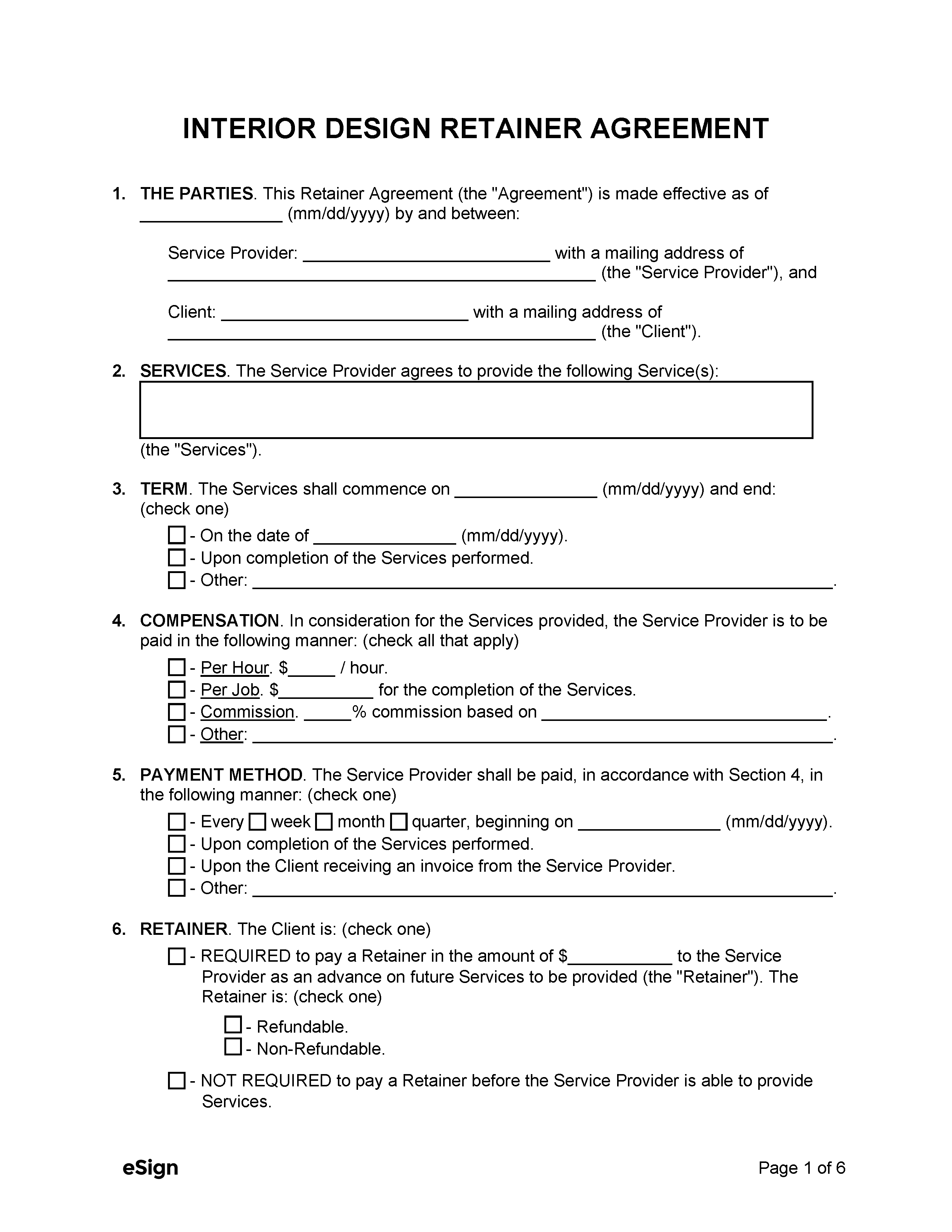

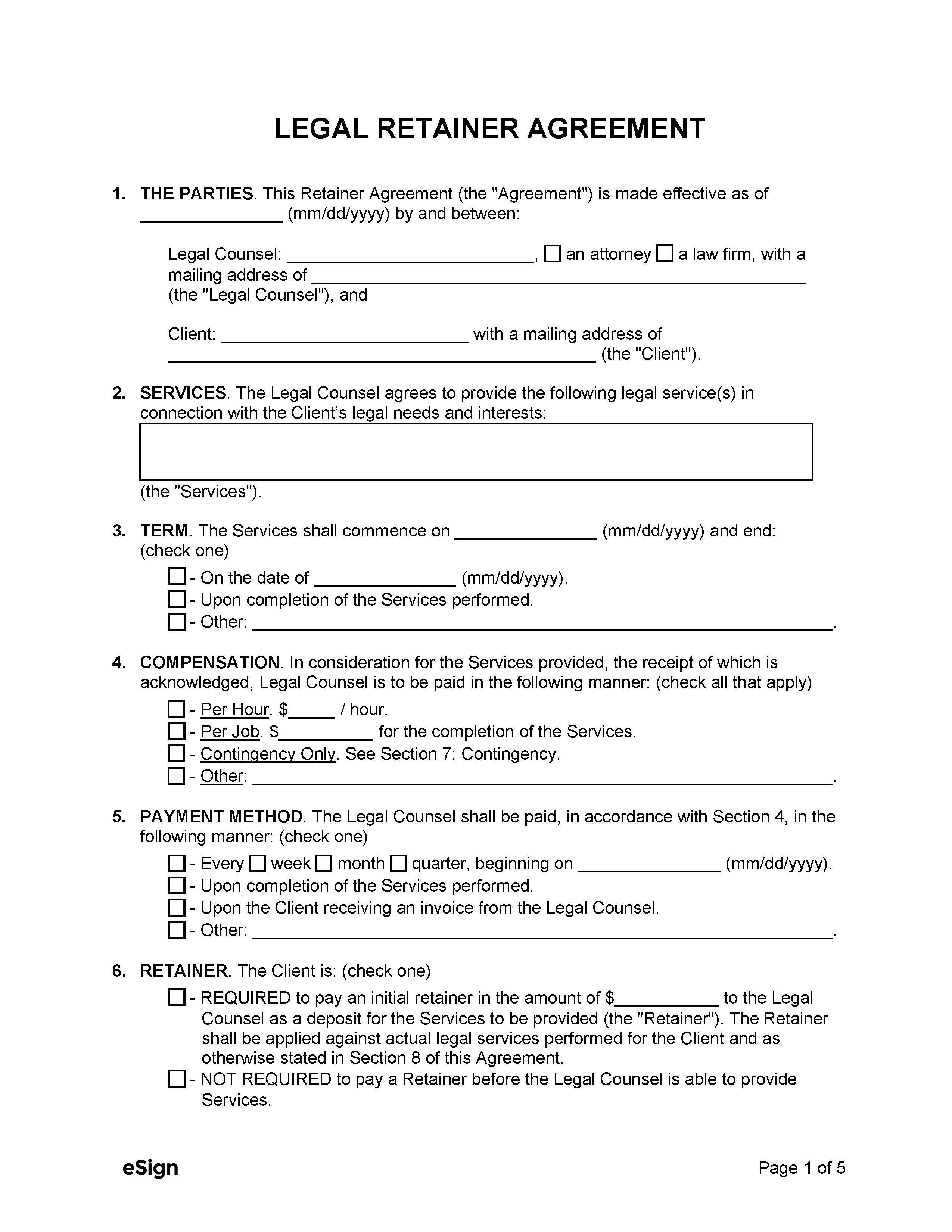

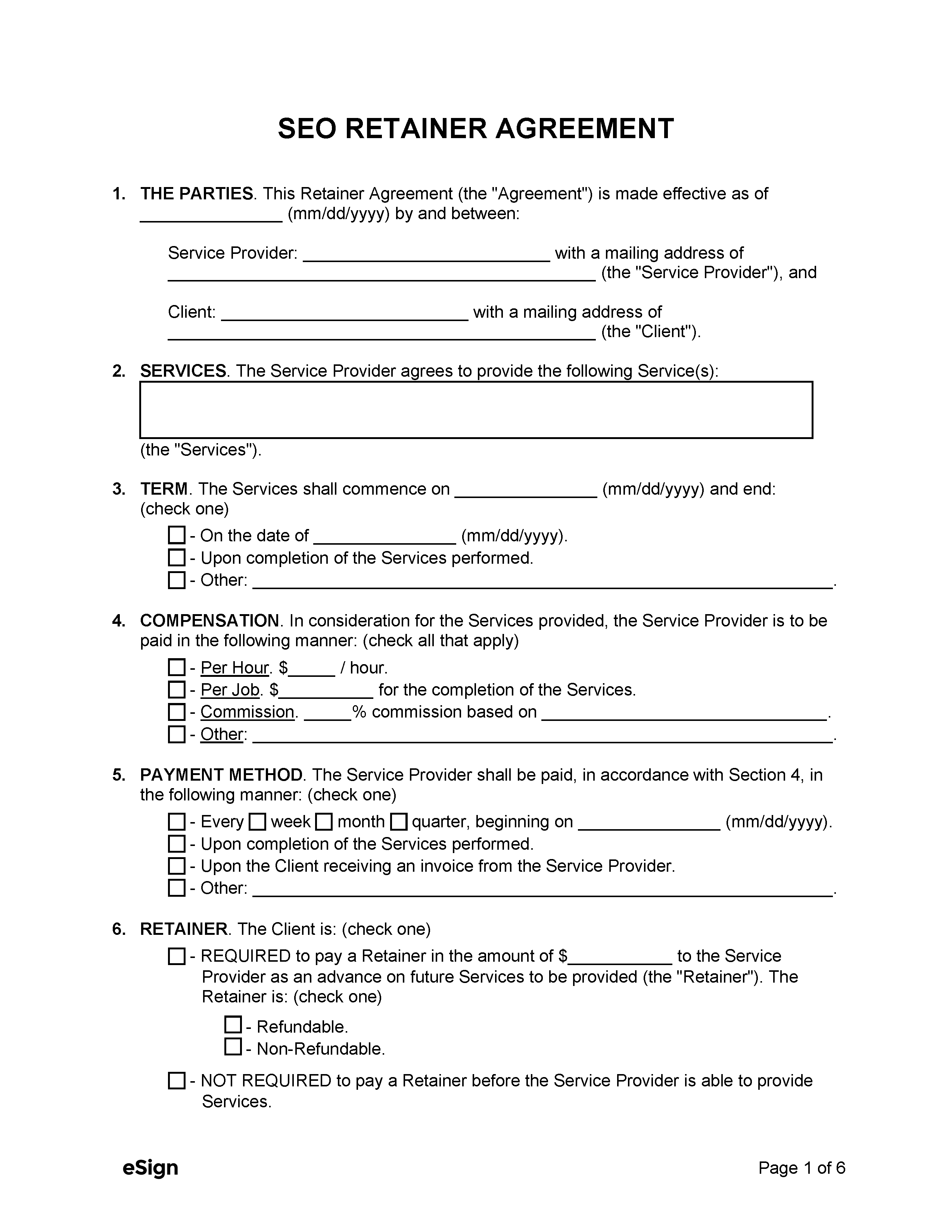

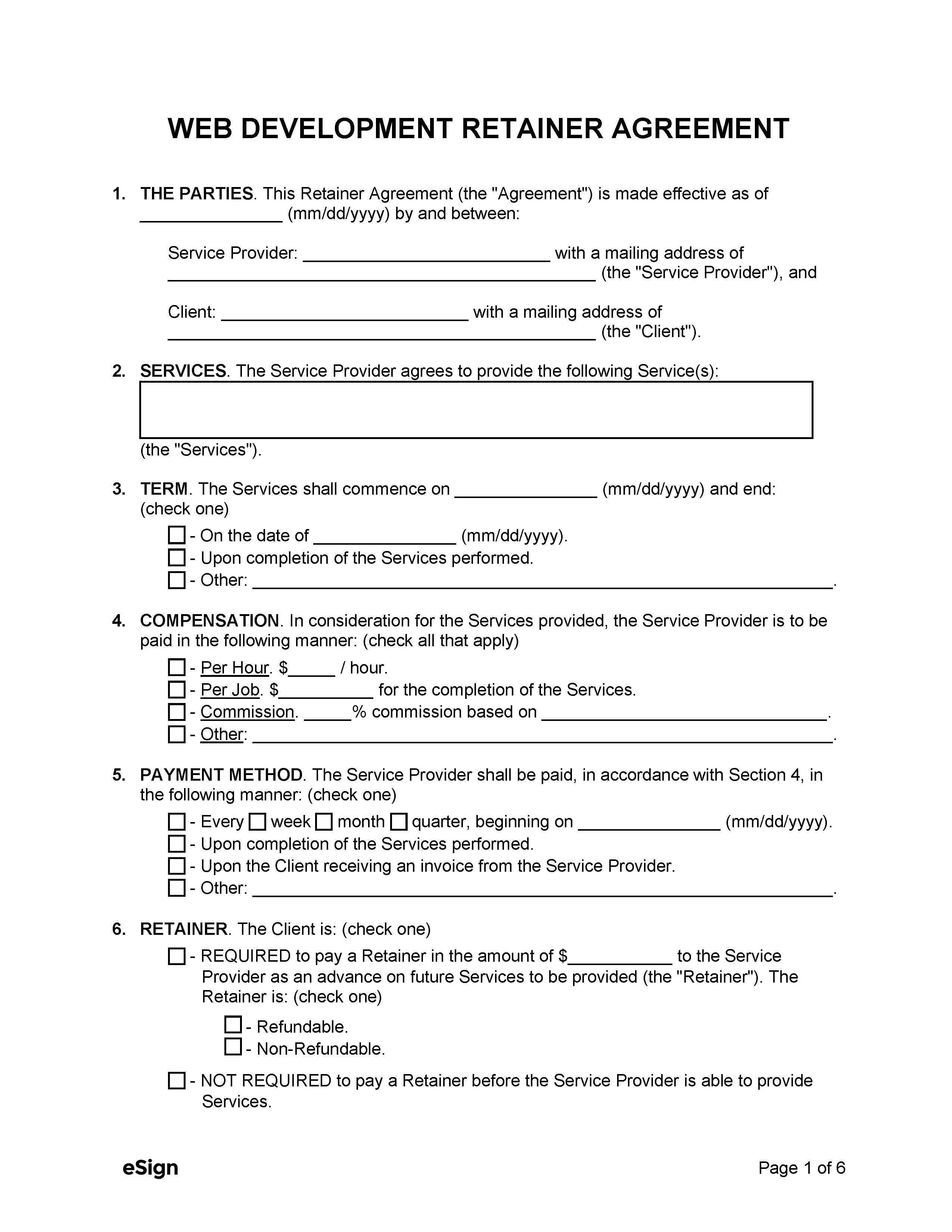

1. THE PARTIES. This Retainer Agreement (the “Agreement”) is made effective as of [MM/DD/YYYY] by and between:

Service Provider: [SERVICE PROVIDER NAME] with a mailing address of

[SERVICE PROVIDER ADDRESS] (the “Service Provider”), and

Client: [CLIENT NAME] with a mailing address of

[CLIENT ADDRESS] (the “Client”).

2. SERVICES. The Service Provider agrees to provide the following Service(s): [DESCRIBE SERVICE(S)] . (hereinafter the “Services”).

3. TERM. The Services shall commence on [MM/DD/YYYY] and end upon either party providing [#] days’ notice.

4. COMPENSATION. In consideration for the Services provided, the Service Provider is to be paid in the following manner [DESCRIBE COMPENSATION] .

5. PAYMENT METHOD. The Service Provider shall be paid, in accordance with section 4, within [#] days upon the Client receiving an Invoice from the Service Provider.

6. RETAINER. The Client is ( ☐ Required | ☐ Not Required) to pay a Retainer. If required, the retainer shall be in the amount of $ [AMOUNT (IF APPLICABLE)] .

7. CONTINGENCY. As part of the Service Provider’s Pay, there ( ☐ Shall | ☐ Shall Not) be a contingency fee arrangement. If applicable, the contingency fee shall be paid in accordance with the following: [CONTINGENCY TERMS (IF APPLICABLE)] .

8. EXPENSES. The Service Provider shall be responsible for the following expenses: [LIST EXPENSES (IF ANY)] .

9. LEGAL NOTICE. All notices required or permitted under this Agreement shall be in writing and shall be deemed delivered when delivered in person or deposited in the United States Postal Service via Certified Mail with return receipt to the addresses listed in Section 1.

If the Client or Service Provider prefers to receive notices to an address differing from the mailing address entered in Section 1, enter any new addresses below:

Client’s Address: [CLIENT ADDRESS] .

Service Provider’s Address: [SERVICE PROVIDER ADDRESS] .

10. DISPUTES. If any dispute arises under this Agreement, the Service Provider and the Client shall negotiate in good faith to settle such dispute. If the parties cannot resolve such disputes themselves, then either party may submit the dispute to mediation by a mediator approved by both parties.

11. RETURN OF RECORDS. Upon termination of this Agreement, the Service Provider shall deliver all records, notes, and data of any nature that are in the Service Provider’s possession or under the Service Provider’s control and that are of the Client’s property or relate to the Client’s business.

12. INDEPENDENT CONTRACTOR STATUS. The Service Provider, under the code of the Internal Revenue (IRS), is an independent contractor, and neither the Service Provider’s employees nor contract personnel are or shall be deemed, the Client’s employees.

13. STATE AND FEDERAL LICENSES. The Service Provider represents and warrants that all employees and associated personnel shall comply with federal, state, and local laws requiring any required licenses, permits, and certificates to perform the Services under this Agreement.

14. EMPLOYEES’ COMPENSATION. The Service Provider shall be responsible for providing their employee’s all state, federal, and agreed-upon benefits, unemployment compensation, and worker’s compensation.

15. INDEMNIFICATION. The Service Provider shall indemnify and hold the Client harmless from any loss or liability from performing the Services under this Agreement.

16. ASSIGNMENT AND DELEGATION. The Service Provider may assign rights and may delegate duties under this Agreement to other individuals or entities acting as a subcontractor (the “Subcontractor”). The Service Provider recognizes that they shall be liable for all work performed by the Subcontractor and shall hold the Client harmless of any liability in connection with their performed work.

17. GOVERNING LAW. This Agreement shall be governed under the laws in the State of [STATE NAME] .

18. SEVERABILITY. This Agreement shall remain in effect in the event a section or provision is unenforceable or invalid.

19. ADDITIONAL TERMS AND CONDITIONS.

[ADD ANY ADDITIONAL TERMS AND CONDITIONS HERE] .

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the dates written hereunder.

Service Provider’s Signature: ______________________ Date: [MM/DD/YYYY]

Print Name: [SERVICE PROVIDER NAME]

Client’s Signature: ______________________ Date: [MM/DD/YYYY]

Print Name [CLIENT NAME]